So that's what's getting into our garbage...

Took this shot with my cellphone last night. (Not)

Wildlife Photos of the Year.

[update: link repaired - sorry]

[via arbroath]

Friday, October 31, 2008

If only China had COOL...

(Maybe it does, but I'm not sure). Considering how it seems anything faintly edible in China contains melamine, I sure hope our ag products exporters are working up a furious campaign featuring how little (as in zero) melamine we feed over here.

I am not implying Chinese food processors are adulterating their products - I'm stating it. By testing not for actual protein but for N (nitrogen) Chinese officials invited their food industry to cheat. Our FDA is trying to stay ahead.

(Maybe it does, but I'm not sure). Considering how it seems anything faintly edible in China contains melamine, I sure hope our ag products exporters are working up a furious campaign featuring how little (as in zero) melamine we feed over here.

Chinese regulators are widening their investigation into contaminated food amid growing signs that the toxic industrial chemical melamine has leached into the nation's animal feed supplies, posing health risks to consumers.

The announcement came after food safety tests earlier this week found that eggs produced in three different provinces in China were contaminated with melamine, which is blamed for causing kidney stones and renal failure in infants. The tests have led to recalls of eggs and consumer warnings.

The reports are another serious blow to China's agriculture industry, which is already struggling to cope with its worst food safety scandal in decades after melamine-tainted milk supplies sickened over 50,000 children, caused at least four deaths and led to global recalls of goods produced with Chinese dairy products earlier this fall.

The cases are fueling global concerns about Chinese food. In Hong Kong, food safety officials announced this week that they would begin testing a wider variety of foods for melamine, including vegetables, flour and meat products. On the mainland, Shanghai and other cities are moving aggressively to test a wide variety of food products for melamine, including fish and livestock feed, according to the state-run news media, which has in recent days carried multiple reports on melamine in animal feed. [More]

I am not implying Chinese food processors are adulterating their products - I'm stating it. By testing not for actual protein but for N (nitrogen) Chinese officials invited their food industry to cheat. Our FDA is trying to stay ahead.

During the recent melamine outbreak, FDA officials suspect that melamine may have been added to infant formula to inflate protein levels cheaply.It almost makes you nostalgic for the good ol' days when all we worried about was MSG in Chinese food.

In some sectors of the food industry in China, manufacturers are paid by the amount of protein in a product. Melamine costs about $1.20 per each protein count per ton, while legitimate protein costs about $6 per protein count per ton.

Melamine, which is used in some pharmaceuticals, dyes, glues and plastics, is normally not harmful to humans, but when it commingles with cyanuric acid, it becomes insoluble and can cause kidney failure.

"The suggestion is that some clever scientist used a high-quality melamine that did not have cyanuric acid," said Dr. Lutter. "It was only later that the melamine was commingled with the cyanuric acid."

But "forecasting economic infiltration is hard," Dr. Lutter said, and food coming across U.S. borders is shipped from countries with disparate regulatory requirements. [More]

Thursday, October 30, 2008

What hath my fingers wrought?...

Below please find the worst post I have ever put up. Sorry about the lack of proofreading - I was trying to get to the field. [Corrections now added]

Battlefield report: Beans surprisingly good. Corn mediocre - well, it varies between "Wow!" and "Holy crap!"

Below please find the worst post I have ever put up. Sorry about the lack of proofreading - I was trying to get to the field. [Corrections now added]

Battlefield report: Beans surprisingly good. Corn mediocre - well, it varies between "Wow!" and "Holy crap!"

BTW, has your Internet connection been slow the last few days?

Wednesday, October 29, 2008

Spread the humor liberally...

I thought about the recent comment concerning left-leaning humorists on the Sound Off! blog. I havelomg [long] been puzzled by the dominance of liberal humorists and the relative paucity of popular right-wing humorists.

There could be several reasons. First, conservatives are about rules, discipline, deferred gratitude, duty, and similar virtues - none of which sound like funny stuff. In short, conservatives don't make good comedians as a rule because they don't see the world as a very funny place.

I was once asked to try writing for The American [Enterprise] - about as far right wing as you can get. They accepted one article, but found the other pieces (which were eventually published elsewhere) as unsuitable because they lacked the stinging satire or brittle edge so prevalent in conservative magazines.

Consider one of the great right-wing humorists: P. J. O'Roarke. I like his stuff, but ita [is] searingly sarcastic to the point of meanness, and not [co]incidentally heavily laden with booze-soaked episodes. So while it cheers the vengeful cadre of those outraged but [by] unjust rewards, it certainly doesn't linger on the taste well after reading it. Compare to Garrison Keillor, who even if you disagree at least tells jokes about the better nature of humanity.

Conservatives spend a lot of time being angry and threatening those who fail to meet their standards of conduct. Note the bald threat from the writer of the e-mail. This is not to pick on him - it's been a feature of his part of the political spectrum for about forever. It could also be because gags from the left get such an angry response,that proof that someone is listening and reacting provokes more. If conservatives couls hrug [could shrug] more off, they might have less to deal with, but they can't pass up even an implied dig.

Non-conservative humorists can work closer to the edge than conservatives who are more adherent toruels [rules] of decorum and taste. Lenny Bruce, George Carlin, Robin Williams - and now Stewart, Colbert and Letterman all dance on the precipice of propriety where our fear of outrage is often the basis for humor.

Look around and back into history. While it could be the entertainment industry has mounted and maintained a powerful blackout on conservative humor for over a century, a more likely explanation of why there is so little conservative humor (and hence humorists) is the right is not very funny, or atleat [least] good at being funny.

When you spend yourtimes [time] preaching right behavior, it's hard to think up gags. Furthermore, the tendency of conservatives to take themselves very seriously really begs to be used as a target. I mean, they are going to be outraged no matter what, so why not make fun of them?

The writer [of the email] wants a balance in humor. He does not suggest any comparablewiters [writers] or performers, and I don't think he (or Agweb) would like the readership scores if we did feature the current offerings from the right.

We don't write the material (well, I try), we just share it. And if you can find reliable comedy with a right-wing stamp of approval send it in. I've looked and right now nothing can touch the combination of wit, sarcasm, and irony that the left produces in quantity every day.

Oh yeah - conservatives can't dance either.

[badly needed corrections]

I thought about the recent comment concerning left-leaning humorists on the Sound Off! blog. I have

There could be several reasons. First, conservatives are about rules, discipline, deferred gratitude, duty, and similar virtues - none of which sound like funny stuff. In short, conservatives don't make good comedians as a rule because they don't see the world as a very funny place.

I was once asked to try writing for The American [Enterprise] - about as far right wing as you can get. They accepted one article, but found the other pieces (which were eventually published elsewhere) as unsuitable because they lacked the stinging satire or brittle edge so prevalent in conservative magazines.

Consider one of the great right-wing humorists: P. J. O'Roarke. I like his stuff, but it

Conservatives spend a lot of time being angry and threatening those who fail to meet their standards of conduct. Note the bald threat from the writer of the e-mail. This is not to pick on him - it's been a feature of his part of the political spectrum for about forever. It could also be because gags from the left get such an angry response,

Non-conservative humorists can work closer to the edge than conservatives who are more adherent to

Look around and back into history. While it could be the entertainment industry has mounted and maintained a powerful blackout on conservative humor for over a century, a more likely explanation of why there is so little conservative humor (and hence humorists) is the right is not very funny, or at

When you spend your

The writer [of the email] wants a balance in humor. He does not suggest any comparable

We don't write the material (well, I try), we just share it. And if you can find reliable comedy with a right-wing stamp of approval send it in. I've looked and right now nothing can touch the combination of wit, sarcasm, and irony that the left produces in quantity every day.

Oh yeah - conservatives can't dance either.

[badly needed corrections]

Why your shopping cart wobbles...

They never really have a chance.

It's amazing they work as well as they do, actually.

[via neatorama]

They never really have a chance.

It's amazing they work as well as they do, actually.

[via neatorama]

Tuesday, October 28, 2008

Another hero unmasked...

Are there no stereotypes we can trust?

[via neatorama]

Are there no stereotypes we can trust?

They say that the Norse explorers, far from being obsessed with fighting and drinking, were a largely-peaceful race who were even criticised for being too hygienic.First, stylish clothing - now personal hygiene? What's next - Vikings who help with the housework?

The university's department of Anglo-Saxon, Norse and Celtic has published a guide revealing how much of the Vikings' history has been misrepresented.

They did not, in fact, wear horned or winged helmets. And they appear to have been a vain race who were concerned about their appearance.

"It seems that the Vikings may not have been as hairy and dirty as is commonly imagined," the guide says.

"A medieval chronicler, John of Wallingford, talking about the eleventh century, complained that the Danes were too clean - they combed their hair every day, washed every Saturday, and changed their clothes regularly."

The guide reveals that Norsemen were also stylish trend-setters: "Contemporaries who met individual Vikings were struck by the extreme bagginess of their trousers. [More]

[via neatorama]

Sunday, October 26, 2008

Wait for it...

Some truly exciting news on the genetic engineering front.

But before we start imagining prescription suds, we need to remember something.

How much do you think the tech fee will be?

Some truly exciting news on the genetic engineering front.

A team of researchers at Rice University in Houston is working to create a beer that could fight cancer and heart disease. Taylor Stevenson, a member of the six-student research team and a junior at Rice, said the team is using genetic engineering to create a beer that includes resveratrol, the disease-fighting chemical that's been found in red wine.

Scientists at the University of Wisconsin in June had called resveratrol, which is a natural component of grapes, pomegranates and red wine, a key reason for the so-called French Paradox -- the observation that French people have lower rates of heart disease despite a cuisine known for its cream sauces and decadent cheeses, all loaded with heart-clogging saturated fats.

The Wisconsin researchers had noted that adding small doses of resveratrol to the diet of middle-aged mice significantly slows their aging and keeps their hearts healthy. And they added that giving high doses to invertebrates extends their life spans, and high doses also stave off premature death in mice fed a high-fat diet.

Stevenson said that the Rice research group, most of the members of which aren't old enough to legally drink alcoholic beverages, came up with the idea of adding resveratrol to beer during a casual conversation about potential projects to undertake. "The idea is that it may have greater effects [in beer than in wine]," he added. "The amount of red wine you'd need to drink to get the same results they get with rats in labs is about half a bottle a day."

He explained that the amount of resveratrol in wine varies from bottle to bottle, since it depends on growing conditions for the grapes and other variables. The researchers felt they could design a beer with higher and more consistent concentrations of the cancer-fighting chemical. [More]

But before we start imagining prescription suds, we need to remember something.

How much do you think the tech fee will be?

The S-word...

A few months ago, I spoke on USFR about income and wealth inequality. I have been writing about it for a couple of years here, and researching the data on what lumped distribution may mean for our nation's future economy and society.

[More]

My main point was while most of us don't think income redistribution via progressive taxes is a cure-all, allowing income and wealth to pile up in a few hands seems historically to have really bad consequences. (Interestingly, one outcome that never seemed to come up was the wealthy would mishandle it badly - as looks like the case today.)

Inevitably, in such conversations name-calling can break out, and the epithet of the moment seems to be "socialist". One of my heroes had pertinent words on this topic and he is admired by a man who decries any hint of socialism.

Further, since we all know how rich the rich are these days, the brain chemistry known as reference anxiety triggers widespread dissatisfaction despite increasing well-being all up and down the spectrum. For a nation which interweaves the ideas of individual equality throughout our political values system, the apparent dichotomy becomes a real bone of contention.

During my commentary I pointed out we are already engaged in various forms of wealth redistribution: progressive income taxes, Medicaid, food stamps, farm program, etc. In fact, all modern democracies sort themselves along a range between capitalism and socialism according to their cultural preferences. It is not black and white.

My European friends are much more socialistic and they don't seem miserable. In fact, the highly socialized economies of Scandinavia consistently report the highest level of happiness.

The reaction from many on the right was sharp. Several long rants (and I think that is fair characterization) about the heresy of socialism, and the slippery slope to godless communism soon arrived in my inbox. Some even worked in gun control and abortion somehow.

Fair enough.

But none offered any answer for the the bi-polar income distribution and its possible effects. And amazingly, most despised the bailout plan as helping the rich, whom in the previous sentence they jut stood up for vehemently.

Well, they may want to rethink. The old s-word has popped up again and it was initiated not by liberal loonies, but by rock-solid Republicans on Wall Street. In a matter of a few weeks, the most right-wing administration in recent history has nationalized banks, insurance companies, money market funds, and who knows what's next.

One possible conclusion that is dawning on many Americans is socialism is all right for capitalists who screw up, but heresy for autoworkers who lost their jobs. The idea of taking my hard earned wealth and giving it to slackers is anathema. The hard right only supports giving it to bumbling members of their own upper caste.

Regardless of the beneficiaries, we are all going to lose significant wealth - or at least have a harder time accumulating it. This will occur whether by outright redistribution mechanisms or unavoidable inflation. Besides, if all the wealth is held by a few, who ya gonna rob?

You can call it what you want, but the sooner we can actually say the word socialism without spitting in contempt, the sooner we can begin to find ways out of this mess.

A few months ago, I spoke on USFR about income and wealth inequality. I have been writing about it for a couple of years here, and researching the data on what lumped distribution may mean for our nation's future economy and society.

[More]

My main point was while most of us don't think income redistribution via progressive taxes is a cure-all, allowing income and wealth to pile up in a few hands seems historically to have really bad consequences. (Interestingly, one outcome that never seemed to come up was the wealthy would mishandle it badly - as looks like the case today.)

Inevitably, in such conversations name-calling can break out, and the epithet of the moment seems to be "socialist". One of my heroes had pertinent words on this topic and he is admired by a man who decries any hint of socialism.

Imagine that instead of telling Joe "the Plumber" Wurzelbacher that "when you spread the wealth around it's good for everybody," Barack Obama had said the following:

We grudge no man a fortune in civil life if it is honorably obtained and well used. It is not even enough that it should have been gained without doing damage to the community. We should permit it to be gained only so long as the gaining represents benefit to the community. … The really big fortune, the swollen fortune, by the mere fact of its size, acquires qualities which differentiate it in kind as well as in degree from what is possessed by men of relatively small means. Therefore, I believe in a graduated income tax on big fortunes, and … a graduated inheritance tax on big fortunes, properly safeguarded against evasion, and increasing rapidly in amount with the size of the estate.

The New York Post's Page One would blare: "OBAMA: I'LL SEIZE 'SWOLLEN FORTUNES'!" Bill Kristol would demand to know, in his New York Times column, what godly powers enabled Obama to discern precisely whose wealth—David Geffen's? George Soros'?—would "benefit the community." On Fox News, Bill O'Reilly would start to say something, then sputter, turn purple, and keel over backward in a grand mal seizure.

John McCain, meanwhile, would have to stop saying that Teddy Roosevelt is his hero, because the passage quoted above is from T.R.'s "New Nationalism" speech of 1910. Either that, or McCain would have to quit calling Barack Obama a socialist. [More]

Further, since we all know how rich the rich are these days, the brain chemistry known as reference anxiety triggers widespread dissatisfaction despite increasing well-being all up and down the spectrum. For a nation which interweaves the ideas of individual equality throughout our political values system, the apparent dichotomy becomes a real bone of contention.

During my commentary I pointed out we are already engaged in various forms of wealth redistribution: progressive income taxes, Medicaid, food stamps, farm program, etc. In fact, all modern democracies sort themselves along a range between capitalism and socialism according to their cultural preferences. It is not black and white.

My European friends are much more socialistic and they don't seem miserable. In fact, the highly socialized economies of Scandinavia consistently report the highest level of happiness.

The reaction from many on the right was sharp. Several long rants (and I think that is fair characterization) about the heresy of socialism, and the slippery slope to godless communism soon arrived in my inbox. Some even worked in gun control and abortion somehow.

Fair enough.

But none offered any answer for the the bi-polar income distribution and its possible effects. And amazingly, most despised the bailout plan as helping the rich, whom in the previous sentence they jut stood up for vehemently.

Well, they may want to rethink. The old s-word has popped up again and it was initiated not by liberal loonies, but by rock-solid Republicans on Wall Street. In a matter of a few weeks, the most right-wing administration in recent history has nationalized banks, insurance companies, money market funds, and who knows what's next.

One possible conclusion that is dawning on many Americans is socialism is all right for capitalists who screw up, but heresy for autoworkers who lost their jobs. The idea of taking my hard earned wealth and giving it to slackers is anathema. The hard right only supports giving it to bumbling members of their own upper caste.

Regardless of the beneficiaries, we are all going to lose significant wealth - or at least have a harder time accumulating it. This will occur whether by outright redistribution mechanisms or unavoidable inflation. Besides, if all the wealth is held by a few, who ya gonna rob?

You can call it what you want, but the sooner we can actually say the word socialism without spitting in contempt, the sooner we can begin to find ways out of this mess.

Friday, October 24, 2008

Well, ecuuuuuse me!....

It seems I have been Americanizing a vegetable name. This news flash from the California Farm Bureau set me straight.

I suppose we need to have the poinsettia argument again.

It seems I have been Americanizing a vegetable name. This news flash from the California Farm Bureau set me straight.

Endive farmers prepare for peak seasonI like it with ketchup and pickles.

All of the endive (pronounced ON-DEEV) grown in the United States is raised in Rio Vista. The vegetable grows on a chicory root in the dark inside the California Vegetable Specialties building. While it is available year-round in white and red varieties, peak demand is during the approaching holiday season. The founder of the endive company suggests that consumers buy the white variety when white, as it turns green after being on the shelf too long. Endive is a nutritious vegetable with large amounts of potassium.

I suppose we need to have the poinsettia argument again.

Xmas Gift Hint # 2008-2...

I thnk this would work well for a junior-high boy obsessed with height.

[More info]

[via presurfer]

The Who Tall Are You Mirror

I thnk this would work well for a junior-high boy obsessed with height.

[More info]

[via presurfer]

Thursday, October 23, 2008

You don't know Jack [o'Lantern]...

Think you carve a mean pumpkin?

Jump back, Jack.

Think you carve a mean pumpkin?

Jump back, Jack.

[More]

[via presurfer]

On second thought, cry for yourself...

Argentina is in a world of hurt economically. After surviving a crippling strike by farmers over export taxes, it now faces default on government debt. In other words, they are going "Iceland".

Meanwhile, the trust level between nations and finance executives dwindles, and in the end, that is the commodity in greatest shortage.

Argentina is in a world of hurt economically. After surviving a crippling strike by farmers over export taxes, it now faces default on government debt. In other words, they are going "Iceland".

That's right, Argentina. Ever the best at trading short-term gain for long-term pain, Argentina is now planning to nationalise private pension funds to help plug a budget gap that could lead to default. There are certain...side effects, however:Although looking backwards, this economic meltdown seems to have come out of nowhere, it did not. Nor will it reverse very rapidly, I believe. As each day reveals new holes in the global financial dike, more pressure is placed on leaders - and citizens - to rise to the occasion.

The yield on the government's 8.28 percent bonds due in 2033 surged 3.2 percentage points to 27.91 percent at 10:10 a.m. in New York, according to JPMorgan Chase & Co. The bonds yielded 12.16 percent a month ago. The price dropped 4.11 cents to 25 cents on the dollar, leaving it down 11.91 cents in the past two days. The benchmark Merval stock index plunged 7.2 percent, extending its decline this week to 20 percent.Felix Salmon writes:

The fear is that they will be forced to dump all their long-term holdings and buy sovereign debt instead: Argentina might need to borrow as much as $14 billion next year, and there's no one willing to lend it that kind of money.It's a damned-if-you-do, damned-if-you-don't scenario, but faced with such a scenario it seems senseless to take desperate measures that undermine confidence at home and abroad. Now, after a brief shining period when high commodity prices and rapid growth in government spending pushed economic expansion forward at an 8% annual rate, Argentina once again finds itself facing a downward spiral, after which it will try once more to rebuild its tattered economy.

That's right, Argentina. Ever the best at trading short-term gain for long-term pain, Argentina is now planning to nationalise private pension funds to help plug a budget gap that could lead to default. There are certain...side effects, however:

The yield on the government's 8.28 percent bonds due in 2033 surged 3.2 percentage points to 27.91 percent at 10:10 a.m. in New York, according to JPMorgan Chase & Co. The bonds yielded 12.16 percent a month ago. The price dropped 4.11 cents to 25 cents on the dollar, leaving it down 11.91 cents in the past two days. The benchmark Merval stock index plunged 7.2 percent, extending its decline this week to 20 percent.Felix Salmon writes:

The fear is that they will be forced to dump all their long-term holdings and buy sovereign debt instead: Argentina might need to borrow as much as $14 billion next year, and there's no one willing to lend it that kind of money.It's a damned-if-you-do, damned-if-you-don't scenario, but faced with such a scenario it seems senseless to take desperate measures that undermine confidence at home and abroad. Now, after a brief shining period when high commodity prices and rapid growth in government spending pushed economic expansion forward at an 8% annual rate, Argentina once again finds itself facing a downward spiral, after which it will try once more to rebuild its tattered economy. [More]

Meanwhile, the trust level between nations and finance executives dwindles, and in the end, that is the commodity in greatest shortage.

Wednesday, October 22, 2008

What's next?...

The credit crisis has become boring. Even x-hundred point moves in the Dow are ho-hum now. Been there, lost that. So after we get this pesky election off the news cycle what could happen next in this wacky year of 2008?

Lot o' layoffs. While credit may be starting flow, it ain't cheap or easy. And spending is plummeting, so look for a wide array of cutbacks in employment.

Second, we will have a period of interest rate and lending turmoil. For example, my small bank is in excellent shape, doing what small banks do: taking deposits and making loans. They also have plenty of money for their regular customers - and even more if they raise their capitalization by participating in the goverment bailout. When I talked with my banker yesterday, I pointed out the irony that as the Fed lowered interest rates - and effectively the prime rate - the interest on my variable was dropping. Meanwhile across town the Farm Credit System is having a tough time flogging their AAA bonds to investors causing their interest rates to jump upward. Unsurprisingly, she was way ahead of me.

This outcome was easily predicted - heck even I saw it coming. But suddenly the big advantage FCS had over banks - access to unlimited capital - has become their Achilles heel. Until credit worries perk up interest in commercial and quasi-government paper, they will struggle with competition.

One player I look to step up big-time is Rabobank. Their extremely conservative Dutch manangment (trust me I know - my father-in-law was Dutch and pretty ummm, tight) has them in a strong position just when they are poised to woo the top tier of ag loans.

My banker has already made it clear that any new lines of credit probably won't be my usual x points below prime. In fact, I anticipate an interest rate floor, as the Fed could to take the prime to dang near zero.

Bottom line, the dating game between lenders and farmers has just entered a wild new phase. Personally, I'm buying candy for my banker. And I may start taking back the dozens of free pens I been filching. There will strong competition from those whose credit is rationed and interest costs are jumping upward. Savvy borrowers are doubtless in her office now trying to get their dirty paws on my loan money, I bet.

Creidt may be easing, but it won't spring back instantly. Some signs are hopeful and talk is increasing of another stimulus package. What to wish for: depreciation breaks, personal exemption, and the Holy Grail: investment tax credits for everything! What we'll more likely get: stupid old roads and bridges.

More thoughts about how the New Financial Order will look from Route 2 as inspiration strikes.

The credit crisis has become boring. Even x-hundred point moves in the Dow are ho-hum now. Been there, lost that. So after we get this pesky election off the news cycle what could happen next in this wacky year of 2008?

Lot o' layoffs. While credit may be starting flow, it ain't cheap or easy. And spending is plummeting, so look for a wide array of cutbacks in employment.

When the dot-com and housing bubbles burst, it was easy to see what types of jobs would disappear. But these days as nervous lenders cower and credit contracts, virtually every industry is likely to be scathed in the widely predicted downturn starting this autumn. Nearly every business relies on credit to operate—just as they need customers to have spending power.How could this affect agriculture? First, by reducing the usual off-farm income that supports many smaller operations. My take is this will make consolidation offers from neighbors - especially if employment is included - look pretty good. Remember the top goal (whether many acknowledge it or not) for many small operators is to live where they now live, not how they make their money.

With lending trimmed, and companies and consumers tightening their belts , jobs will be cut across broad swaths of the economy, from the tech sector to investment banking, and from manufacturing to soft drinks.The four-week moving average of U.S. jobless claims hit its highest point in seven years, the Labor Dept. reported on Oct. 20. The average number of new jobless claims rose to 483,250 for the week ended Oct. 11, the highest since 2001. September's unemployment rate was unchanged at 6.1%, but economists generally predict the labor picture will deteriorate in coming months.[More]

Second, we will have a period of interest rate and lending turmoil. For example, my small bank is in excellent shape, doing what small banks do: taking deposits and making loans. They also have plenty of money for their regular customers - and even more if they raise their capitalization by participating in the goverment bailout. When I talked with my banker yesterday, I pointed out the irony that as the Fed lowered interest rates - and effectively the prime rate - the interest on my variable was dropping. Meanwhile across town the Farm Credit System is having a tough time flogging their AAA bonds to investors causing their interest rates to jump upward. Unsurprisingly, she was way ahead of me.

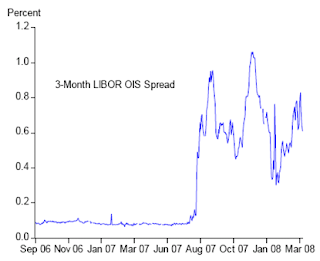

In the last week, virtually every Farm Credit Association in the country has been forced to impose record, one-time hikes in operating credit and farm mortgage rates. Five-year adjustable mortgages for qualified customers at Louisville-based Farm Credit Services of Mid-America, for example, jumped to 7.35 percent this morning, up from 6.15 percent on Oct. 8. Libor-indexed variable-rate operating credit now runs 7.3 percent, up from 5.25 percent during the first week of October. For the moment, variable-rate operating loans (which flex with prime rates) are set at 5.4 percent. (See DTN's Ag Interest Rate Snapshot, updated daily on the Farm Business page.)

In e-mail messages, FCS of Mid-America's Treasurer Bill Lankswert said financial markets are undergoing more uncertainty than at any time since the Great Depression. The 30-day Libor rate is used to price short-term borrowing by many agricultural producers and agribusiness and "is an indication of costs for most other businesses in the United States," Lankswert noted. "In the past week, the rate peaked at 4.56 percent, up from less than 2.50 percent just two weeks ago. The increase in the Libor and other related rates mean that many borrowers will, or have already, seen a quick increase in short-term borrowing costs."

Omaha-based FCS of America prices its retail loans based on a slightly different formula, but customers who thought their operating lines bore some link to the nation's prime rate will be disappointed. "All of the normal benchmarks we have used to price loans have changed," said Stark, whose territory covers Iowa, Nebraska, South Dakota and Wyoming. "Even prime rates bear no relationship to our costs anymore. Borrowers who were normally charged rates of a half-point under prime may find themselves at a half-point or one point over prime now." [More]

This outcome was easily predicted - heck even I saw it coming. But suddenly the big advantage FCS had over banks - access to unlimited capital - has become their Achilles heel. Until credit worries perk up interest in commercial and quasi-government paper, they will struggle with competition.

One player I look to step up big-time is Rabobank. Their extremely conservative Dutch manangment (trust me I know - my father-in-law was Dutch and pretty ummm, tight) has them in a strong position just when they are poised to woo the top tier of ag loans.

While this will lead to higher margins, we will have to pay more attention to the funding than in the past. We must enter into reciprocal relationships with clients. This means that, while we have until now often been a primarily credit-driven organisation, we must now also focus on including savings and deposits in our client relationships.

Rabobank is in good shape. It is, in fact, rock solid. This is the result of 100 years of frugal banking. We have always ensured that we maintained extremely strong buffers. We have a Tier-1 solvency ratio of more than 10 percent and a well-diversified range of activities. The crisis does, however, demand that we realign our strategy for the Netherlands and abroad.

In the Netherlands we must seize opportunities primarily in the business market and in the field of private banking. In the international arena we must focus even more sharply on our core business, i.e. food & agri and sustainable enterprise (CleanTech). We must move forward with the expansion of retail in other countries, including intensifying our activities in developing countries. This forms part of our commitment to implement Raiffeisen’s mission in the year 2008. [More]

My banker has already made it clear that any new lines of credit probably won't be my usual x points below prime. In fact, I anticipate an interest rate floor, as the Fed could to take the prime to dang near zero.

Bottom line, the dating game between lenders and farmers has just entered a wild new phase. Personally, I'm buying candy for my banker. And I may start taking back the dozens of free pens I been filching. There will strong competition from those whose credit is rationed and interest costs are jumping upward. Savvy borrowers are doubtless in her office now trying to get their dirty paws on my loan money, I bet.

Creidt may be easing, but it won't spring back instantly. Some signs are hopeful and talk is increasing of another stimulus package. What to wish for: depreciation breaks, personal exemption, and the Holy Grail: investment tax credits for everything! What we'll more likely get: stupid old roads and bridges.

More thoughts about how the New Financial Order will look from Route 2 as inspiration strikes.

Monday, October 20, 2008

Xmas Gift Hint # 2008-1...

The ultimate popup book (to date):

The ultimate popup book (to date):

I just play one on TV...

I don't claim to be a market adviser, but inevitably some off-hand comment I make on camera will be miraculously right and USFR viewers will place too much weight on it. But I would share this helpful insight into the volatility we are seeing everywhere.

How will routine market moves of 20 cents in corn, 50 cents in soy and 40 in beans change our marketing? I don't think we know right now, but I suspect the toll taken on our psychological well-being will be immense unless we adopt protective measures.

I don't claim to be a market adviser, but inevitably some off-hand comment I make on camera will be miraculously right and USFR viewers will place too much weight on it. But I would share this helpful insight into the volatility we are seeing everywhere.

The second point is an obvious one: in a market, this kind of phenomenon feeds on itself, particularly in the short-run. If traders believe that they’re going to get huge moves in the last hour of trading, then they’re likely to act in ways that create huge moves. Certainly if you were watching the market yesterday, your heart had to be beating a lot faster around 3 P.M. What was interesting about yesterday, though, was that while it seemed a foregone conclusion that we’d get a huge point move in the last hour, it was totally unclear in what direction that move would be. And that’s very different from a week and a half ago. [More]I don't know about you, but I now expect weird things to happen between 1 PM and 1:15 PM in Chicago. And I'm not just talking about the Daley administration.

How will routine market moves of 20 cents in corn, 50 cents in soy and 40 in beans change our marketing? I don't think we know right now, but I suspect the toll taken on our psychological well-being will be immense unless we adopt protective measures.

Sunday, October 19, 2008

Theme music for the credit crisis...

Believe it or not, good ol' J. S. Bach wrote a little heavy duty music that fits our day.

If that fails to cheer you, consider this way-too-late investment advice.

In fact, I think I'm going to make a small investment right now.

[Thanks, Kaye]

Believe it or not, good ol' J. S. Bach wrote a little heavy duty music that fits our day.

When times are hard we are supposed to find solace in art that lifts the spirits, like the feelgood films of 1930s Hollywood or the shameless abandon of 1970s disco. But if you've seen your Icesave account melt away and the price of your house fall through the floor, you might want to listen to a recording of Bach's short, rarely performed Cantata 168, a setting of passages on the parable of the unjust steward from Corinthians and the Gospel of Luke. It won't bring you much solace – at least not until the closing chorus of consolation – but you will be able to feel and share the anger and the wrath, directed at bankers and accountants.The opening bass aria is a pungent, ardent attack on the money men of 1720s Weimar, around the words "Tue Rechnung! Donnerwort!" literally "Give an account of yourself, word of thunder", but sometimes translated as "Thine Accounting! Judgment Day!" The bass vents his spleen amid a swirl of music like a demented broker seeing all his screens turn red, who thrashes around before finally pledging to be a good steward who puts his trust in the lord.Before the tenor takes up his aria, a timely reminder that "Capital and interest must one day be settled", he tells us in the recitative how he shudders with horror when he realises that his "accounts are so full of faults". The bass, having secured his own salvation, now implores him "to look to your guarantor who does away with all your debts" – God, presumably, rather than Gordon Brown and the taxpayer – and praises those good stewards who "take care and do not forget to use Mammon prudently, to do good to the poor". A duet for soprano and alto promises the virtuous a "firm house … when the earth's goods turn to dust", before the closing chorale's celebration of God's "joyful spirit".[More]

If that fails to cheer you, consider this way-too-late investment advice.

If you had purchased $1,000 of shares in Delta Airlines one year ago,you would have $49.00 today. If you had purchased $1,000 of shares in AIG one year ago, you would have $33.00 today. If you had purchased $1,000 of shares in Lehman Brothers one year ago, you would have $0.00 today.

But if you had purchased $1,000 worth of beer one year ago, drunk all the beer, then turned in the aluminum cans for recycling refund, you would receive $214.00.

Based on the above, the best current investment plan is to drink heavily and recycle. It is called the 401-Keg. [More]

In fact, I think I'm going to make a small investment right now.

[Thanks, Kaye]

Saturday, October 18, 2008

Mom's soup recipe...

That would be Mother Earth's primordial soup, of course. It turns out early experiments showing how basic compounds in our planet's early stages contained the ingredients for life to emerge were more prescient than even imagined.

These advances actually diminish our loneliness.

That would be Mother Earth's primordial soup, of course. It turns out early experiments showing how basic compounds in our planet's early stages contained the ingredients for life to emerge were more prescient than even imagined.

The first experiments remained iconic in their attempt at simulating pre-biotic chemistry, but became irrelevant in detail.I have long believed - perhaps against reason - that life was more prolific than our tiny planet suggests. It a big universe and there is room for many more. As we uncover more about this process, the wrong conclusion is it diminishes humanity.

But conditions locally in volcanoes, says Professor Bada, might not have been so different. The trouble was, Miller published only the sketchiest of details of those tests, and the apparatus was lost. It had looked like a dead end, until those dusty boxes turned up with their 200 vials.

"We started sorting through these, and lo and behold, we found a whole collection, almost a complete collection, of the extract samples from the volcanic experiments. And so we just went at it, using the state-of-the-art techniques we have today and analysed these samples.

"We found not only did these make more of certain amino acids than in the classic experiment, but they made a greater diversity of amino acids."

Miller, using the old methods, had found five amino acids; Jeffrey Bada and his teams tracked down 22. What is more, the overall chemical yields were often higher than in the first set of experiments - the mixture appeared to be more fertile.

Professor Bada points out that today, almost all volcanic eruptions are accompanied by violent electric storms. The same could have been true on the young Earth.

"What we suggest is that volcanoes belched out gases just like the ones Stanley had used, and were immediately subjected to intense volcanic lightning. "And so each one of those volcanoes could have been a little, local prebiotic factory. And so all of that went into making the material that we refer to as the prebiotic soup." [More]

These advances actually diminish our loneliness.

Just eyeball it...

How good is your visual estimating? Farmers are convinced they can guesstimate about anything, so take the test.

My score: 3.79

[via info nation]

How good is your visual estimating? Farmers are convinced they can guesstimate about anything, so take the test.

My score: 3.79

[via info nation]

Friday, October 17, 2008

What's the capital of Iceland?...

(Ba-dump-bump)

More financial crisis jokes here.

Answer: about $20.

(Ba-dump-bump)

More financial crisis jokes here.

Thursday, October 16, 2008

It's October 17...

Mine are still where I left 'em a few months ago, mostly. Someone asked me at the elevator how we are getting along. I referred to my official finishing language to explain.

Do you know where your crops are?

Mine are still where I left 'em a few months ago, mostly. Someone asked me at the elevator how we are getting along. I referred to my official finishing language to explain.

The Done and the Undone

“You done?” my friend asked. I, of course, fully anticipated this opening query andForgive the laziness - I started to excerpt and thought what the hey? Some of you are too tragically young to have ever seen this.

had even crafted my reply as painstakingly as a press secretary during a sex

scandal. This conversation was the real reason I didn’t want to come to choir

practice in the first place.

Being DONE - that metaphysical state of agricultural nirvana that we get to

experience twice a year (we hope). Beyond the completion of an intensive effort to

plant or harvest, it is also the agonizing finish of a race with neighbors and friends.

And despite scientific evidence to the contrary and professed disavowal on our part

of the “racehorse” mentality, speed still counts in the manly evaluation of farming

prowess.

Done is a state of higher existence, a lofty, carefree plateau of superiority from

which to pity our slower, and therefore, lesser neighbors. It means falling asleep

easier, tasting our food, and speaking to our friends again. During particularly bad

seasons it can also mean the ability to communicate verbally in something other

than grunts.

Periodically it is necessary to check with others to see what the score is. The score

keeping system, however, can be confusing, like a cross between cribbage and

tennis. For outsiders or beginners, let me offer this handy clip-and-save guide for

answers to this eternal question.

Just started [Actual completion 0%] The idea of planting or harvesting seems

reasonable, and significant efforts in that direction will now commence. Fields

look like they are supposed to look, and the increase in activity in the

neighborhood is noticeable.

Not near done [Still 0%] This phrase indicates that most of the major machinery

necessary (planter, combine, trucks, grain bins, etc.) have been located and the

prospect of actually getting into the fields now looms as likely within a week or so.

Half-done [25-33%] The concept of “half” here is sort of metaphorical and subject

to free interpretation. Field work has actually been accomplished and one or two

fields may be completed.

Almost done [40-66%] This phrase is used less to indicate an actual performance

mark than to revive flagging spirits who can no longer remember doing anything else other than planting or harvesting. It indicates the approximate midpoint of a

seemingly endless endeavor. It is the same phrase shouted to marathon runners at

around Mile 11. First use of this phrase in a group of competitors can galvanize the

whole neighborhood into renewed frenzy.

‘Bout done [66-75%] [Note: Many neophytes will misunderstand the subtly

shaded meanings of these phrases. In some sections of the country they may also

appear in different order, as well. Be sure to check closely with more experienced

operators to make sure you are “talkin’ the talk”. Above all, do not be misled into a

literal interpretation.] This phrase indicates the actual possibility of finishing has

slowly emerged as a non-humorous comment. By stringing several pieces of good

fortune together (combine keeps running, miss the next two rains, elevator doesn’t

slow down, etc.) completion is now imaginable.

‘Pert near done [75-85%] [Again, local usage varies] This phrase is used almost

exclusively to update a report of “bout done” at the previous conversation. Some

progress must, of course, be made, without actually acknowledging a fixed level of

accomplishment. ‘Pert near usually indicates the shift from active interest into

obsession with getting done. The heady odor of completion drifts on the wind like

an agricultural pheromone. Consequently, bad farming may be about to occur.

Done all ‘cept ... [90%] This phrase is followed by softly mumbled caveats similar

to car financing disclaimers. It indicates that outside agencies [crop sprayers,

elevators, rain, landlord peculiarities, etc.] let you down. Mostly it announces that

it’s not your fault you’re not done, and therefore you can use the sacred word to

begin your statement.

Done [95%] Virtual completion. Some rounding error may occur. You must have

no complete fields left, and a clear window for the beloved last round. Test plots,

wet holes, male corn, dryer bottlenecks are typical allowable exclusions. It is at this

point that the physical “completion letup” degrades rapidly to a full-body

meltdown.

ALL Done [100%] [Note: pronounced with emphasis on the “ALL”] Fields are

fully completed, machinery has been herded home, trucks emptied, bins and sheds

closed. Appetites and obnoxiousness are peaking. Immediately after achieving this

status, maximum time is spent cruising the neighborhood to share this happy news

with the less fortunate.

Example: This article is ALL Done.

It's a battle in there, folks...

Inside your noggin at least two conflicting trends may be going on. One is a good thing.

Another is a not-so-good thing. Maybe.

This is not the way this report was widely summarized by the media, but seems to me to be the fairest conclusion.

Look at it this way: the more your surf, the more you can drink.

Inside your noggin at least two conflicting trends may be going on. One is a good thing.

A University of California Los Angeles team found searching the web stimulated centres in the brain that controlled decision-making and complex reasoning.

The researchers say this might even help to counteract the age-related physiological changes that cause the brain to slow down. [More]

Another is a not-so-good thing. Maybe.

Aging shrinks your brain, about 2% per decade. Alcoholism — regular heavy drinking — can accelerate this slightly. But even the alcoholics had brains just 1.5% smaller than the abstainers in the study published in the Archives of Neurology. [More]

This is not the way this report was widely summarized by the media, but seems to me to be the fairest conclusion.

Look at it this way: the more your surf, the more you can drink.

Worm charming explained...

Every week I get hundreds of e-mails asking, "John, please explain what I should do with this old rooping iron."

With this mystery explained, now I can finally get my 2008 grain marketing program started.

Every week I get hundreds of e-mails asking, "John, please explain what I should do with this old rooping iron."

With this mystery explained, now I can finally get my 2008 grain marketing program started.

Meanwhile, across the Pacific...

The Chinese are making economic history themselves.

The savings glut in China fuels our prosperity (er, former prosperity), largely because savers have no choice. And the numbers are huge.

Now imagine if that flow now channeled into US Treasury notes was retained in China to buy cars and refrigerators and vacations to Shanghai. We'd really miss those debt buyers, just when our debt is exploding.

We have turned a corner into a new economic corridor - narrower than many we have traveled down as fellow citizens. It would appear growth will occur much more slowly - similar to Japan or the EU - as a result of new layers of regulation and the loss of trust.

While I do not think this recession will be comparable to the Great Depression, it is similar to the Panic of 1873, something none recall firsthand.

The bottom line then was it took six years to recover.

The Chinese are making economic history themselves.

While the rest of the world is fixated on the biggest financial meltdown since the Great Depression of last century, it may seem odd that the highest decision-making body of the Chinese Communist Party (CCP) has been holed up for four days talking about farmers. There is, however, an important connection.It is difficult to overestimate how big this decision could be. While farmers in the US will certainly focus on the idea of more efficient Chinese competitors or on the other hand more Chinese demand for food and things agricultural, I don't think this is the real bottom line.

The collapse of the global financial system has made reform of China's land-use regime - a hot-button issue since former paramount leader Deng Xiaoping first began pushing the country toward a market economy more than 30 years ago - all the more urgent.

With Chinese exports expected to slow dramatically as the world economy contracts, the country's leaders want to boost domestic consumption by spreading China's newfound wealth beyond the cities - where it has created breathtaking modern architecture and a new class of millionaires - to the still-impoverished countryside, where two-thirds of the population continues to live. At the same time, increasing farmers' incomes could go a long way toward quelling rising social unrest often attributable to rural land disputes and the massive wealth gap between rural and urban China. [More]

The savings glut in China fuels our prosperity (er, former prosperity), largely because savers have no choice. And the numbers are huge.

John Hempton at Bronte Capital has a novel explanation for China’s stratospheric savings rate. He says it’s due to their one-child policy. In any pre-Industrial economy, you’re retirement savings plan was very simple, you had children. Now you can’t so to compensate, you save, save, save. Hempton’s reckons “that the average Chinese person is saving maybe 46 percent of their income”. [More]

Now imagine if that flow now channeled into US Treasury notes was retained in China to buy cars and refrigerators and vacations to Shanghai. We'd really miss those debt buyers, just when our debt is exploding.

The shortfall widened to $455 billion in the fiscal year ended Sept. 30, compared with a $162 billion deficit a year earlier and the previous high of $413 billion in 2004, the Treasury said today in Washington. The gap was 3.2 percent of gross domestic product, up from 1.2 percent last year, the Treasury said. The 2008 deficit was the largest as a share of the economy since 2004, when it was 3.6 percent of GDP.

The excess of expenditures over receipts this year could get even worse. As the Treasury uses $700 billion to rescue the financial system from the credit crisis, Morgan Stanley chief economist David Greenlaw predicts the shortfall may almost quadruple to about $2 trillion. [More]

We have turned a corner into a new economic corridor - narrower than many we have traveled down as fellow citizens. It would appear growth will occur much more slowly - similar to Japan or the EU - as a result of new layers of regulation and the loss of trust.

In late 1930, however, a rolling series of bank panics began. Investments made by the banks were going bad — or, in some cases, were rumored to be going bad — and nervous customers besieged bank branches to demand their money back. Hundreds of banks eventually closed.

Once a bank in a given town shut its doors, all the knowledge accumulated by the bank officers there effectively disappeared. Other banks weren't nearly as willing to lend money to local businesses and residents because the loan officers at those banks didn't know which borrowers were less reliable than they looked. Credit dried up.

"If a guy has a good investment opportunity and he can't get the funding, he won't do it," Mishkin, who's now an economics professor at Columbia, notes. "And that's when the economy collapses." Or, as Adam Posen, another economist, puts it, "That's when the Depression became the Great Depression." By 1932, consumption and investment had both collapsed, and stocks had fallen more than 80 percent from their peak. [More]

While I do not think this recession will be comparable to the Great Depression, it is similar to the Panic of 1873, something none recall firsthand.

The bottom line then was it took six years to recover.

Monday, October 13, 2008

I am Phipps: Destroyer of Demand...

Gosh - that sounds more dangerous than most descriptions I've heard. And trust me, I am going to destroy a little demand for inputs, and I suspect I'm not alone. I don't believe in organized boycotts, but many of us will arrive at the same conclusions based on similar data. Not only that, be we may have some powerful help.

Consider this comment from below:

Several reasons for this action. First, I am soil sampling everything, and for the most part my P & K are in very good shape. But more importantly, it took several years of massive applications to raise those levels to where they are. I suspect one year of underapplying won't even be seen in subsequent tests. Ken Ferrie has convinced me we are not even close to utilizing our latent soil nutrients. And my European buddies have produced enormous yields with rationed fertilizer for years.

In short, we may be about to change the rules for fertilizer application - and I don't think this vast experiment is what fertilizer producers really intended to happen. Stratospheric prices will reward nutrient use efficiency big-time.

Second, although the input industry argument of costly seed and fertilizer will generate higher yields, they don't offer any money back guarantees for those increases, I notice. The odds of them getting my hundreds of dollars per acre are 100% (my checks don't bounce). However, the odds of me getting the promised returns are not as high, and have frequently been disappointing.

Third, the premium for non-GMO corn has jumped again, and with corn now below $4, it represents a significant boost - unlike when were selling for $6+. Conventional seed is almost $180 cheaper than the hot numbers. These are the same hybrids I loved just a few years ago, and I can handle the first-year rootworm pretty well to date.

To be fair, seed corn prices in my area have broken from the hardline "red-faced" ultimatum we heard just a few weeks ago. I've been hearing "whatever it takes" and "we'll work with you" instead of "take it or leave it". Recent seed company profit announcements add a little secret revenge in saying no as well. Call me a flawed human being, I guess.

But the comment above is the real clincher. There is no bank so sound it can underwrite business plans that bet on the come in any industry. Auditors will be all over loan apps for the next three decades or so. If I can't show a healthy margin with numbers obtainable right now, I won't get scarce credit.

My sources in the fertilizer industry indicate they are convinced the days of "5/90" will be back soon: $5 corn and 90 million acres. Also the emerging economies will snap back ferociously to gobble up anything at any price. But their dealers are getting nervous about piles of P & K in their warehouses that are not being spread, even if booked.

Input suppliers are going to have to learn the same lessons the housing industry is bleeding from: prices go down, too. When they do break, the momentum downward will be fierce too, as buyers will want to recover what they saw as gouging just a few months ago. Farmers read the same profit guidance from company execs as stock analysts, and we know from whose farms those profits were extracted.

Add in irate pre-payers, and a real cash flow problem (will you pre-pay with prices dropping?) and they have made normal market action about as painful as it can be for themselves. And simply because they thought market forces would stop applying to them.

Bad news, folks. We producers thought the same thing up until August.

Gosh - that sounds more dangerous than most descriptions I've heard. And trust me, I am going to destroy a little demand for inputs, and I suspect I'm not alone. I don't believe in organized boycotts, but many of us will arrive at the same conclusions based on similar data. Not only that, be we may have some powerful help.

Consider this comment from below:

Please tell me how a lender, (I am a lender and a farmer) is going to justify an annual operating loan or line of credit to plant 2009 crops? (even if we have the money to lend, remember FSA raised the loan limits by 50% with no increase in funding, so the current funding could be exhausted on only 66% of current borrowers!!) We need a positive cash flow and at current crop prices and input costs are going to make that difficult. I was told yesterday that soybeans will be $54 for 50# bag next year. (Do I have enough Monsanto stock??!!!) $70 seed cost, $50 chemicals, $150 fertilizer, $125 machinery, and $225 for land needs national average of 155 bpa at $4.00 to break even. I remember talk about Brazil farmers not being able to plant crops beacuse financing was not available several years ago when inflation was rampant. Maybe the canary is indeed coughing!! My fence post or seat of the tractor economics would say we need to lower interest to get liquidity into these markets and get some kind of floor under everything right now, and since we can not produce our selves out of this 'crisis', we need to get out of the way as we need to inflate ourselves out of this.Thus is the same story my spreadsheet is telling me, and buying seed and fertilizer differently is one of highest paybacks I see to help me creep back toward a black bottom line.

Several reasons for this action. First, I am soil sampling everything, and for the most part my P & K are in very good shape. But more importantly, it took several years of massive applications to raise those levels to where they are. I suspect one year of underapplying won't even be seen in subsequent tests. Ken Ferrie has convinced me we are not even close to utilizing our latent soil nutrients. And my European buddies have produced enormous yields with rationed fertilizer for years.

In short, we may be about to change the rules for fertilizer application - and I don't think this vast experiment is what fertilizer producers really intended to happen. Stratospheric prices will reward nutrient use efficiency big-time.

Second, although the input industry argument of costly seed and fertilizer will generate higher yields, they don't offer any money back guarantees for those increases, I notice. The odds of them getting my hundreds of dollars per acre are 100% (my checks don't bounce). However, the odds of me getting the promised returns are not as high, and have frequently been disappointing.

Third, the premium for non-GMO corn has jumped again, and with corn now below $4, it represents a significant boost - unlike when were selling for $6+. Conventional seed is almost $180 cheaper than the hot numbers. These are the same hybrids I loved just a few years ago, and I can handle the first-year rootworm pretty well to date.

To be fair, seed corn prices in my area have broken from the hardline "red-faced" ultimatum we heard just a few weeks ago. I've been hearing "whatever it takes" and "we'll work with you" instead of "take it or leave it". Recent seed company profit announcements add a little secret revenge in saying no as well. Call me a flawed human being, I guess.

But the comment above is the real clincher. There is no bank so sound it can underwrite business plans that bet on the come in any industry. Auditors will be all over loan apps for the next three decades or so. If I can't show a healthy margin with numbers obtainable right now, I won't get scarce credit.

My sources in the fertilizer industry indicate they are convinced the days of "5/90" will be back soon: $5 corn and 90 million acres. Also the emerging economies will snap back ferociously to gobble up anything at any price. But their dealers are getting nervous about piles of P & K in their warehouses that are not being spread, even if booked.

Input suppliers are going to have to learn the same lessons the housing industry is bleeding from: prices go down, too. When they do break, the momentum downward will be fierce too, as buyers will want to recover what they saw as gouging just a few months ago. Farmers read the same profit guidance from company execs as stock analysts, and we know from whose farms those profits were extracted.

Add in irate pre-payers, and a real cash flow problem (will you pre-pay with prices dropping?) and they have made normal market action about as painful as it can be for themselves. And simply because they thought market forces would stop applying to them.

Bad news, folks. We producers thought the same thing up until August.

Sunday, October 12, 2008

Underwear poetry...

This week on US Farm Report my commentary was about a part of my past with my father. This was the script I wrote:

Plus we've been cutting beans all day, and I'm whacked.

Anyhoo, thank for watching, and I hope this reminds you of your father.

This week on US Farm Report my commentary was about a part of my past with my father. This was the script I wrote:

As a boy, my late father had the irritating habit of being able to make me laugh just when I was busy sulking or worrying. On one occasion after a particularly poor grade school basketball game, he threw his arm around me and solemnly recited:

The limerick was not original, but a lively discussion broke out with my colleagues at USFR about where it came from. While it was quoted used in a similar form in Caddyshack, the doggerel originated with Morey Amsterdam on a 78 rpm. record circa 1950. I learned this from my original search, but I'm danged if I can find it now.Johnny -Unfortunately, he repeated this ditty so many times that it remains one of my most powerful memories. So much so that this week, as I felt the panic around and within me, the words sprang unbidden to my lips - and I laughed again.

Any man can grin when his ship has come in,

And it's all tied up at the dock.

But the man who's worthwhile

Is the man who can smile

When his underwear's tied in a knot.

So now, in times of stress, I channel my father. Thanks a lot, Dad.

My father could be quite silly, but maybe he was on to something. Psychologists tell us laughter is a potent tool to interrupt fear feedback loops - or panic.

So even if he was just cheering up a small boy with small problems, he was actually preparing a bigger boy for bigger problems. And maybe make me a little more worthwhile to those around me as well.

Let me rephrase my previous words:

Dad - thanks a lot!

Plus we've been cutting beans all day, and I'm whacked.

Anyhoo, thank for watching, and I hope this reminds you of your father.

Friday, October 10, 2008

Absolutely spotless...

No wonder it's called clean energy.

[via futurepundit]

No wonder it's called clean energy.

The image, taken by the Solar and Heliospheric Observatory (SOHO) on Sept. 27, 2008, shows a solar disk completely unmarked by sunspots. For comparison, a SOHO image taken seven years earlier on Sept. 27, 2001, is peppered with colossal sunspots, all crackling with solar flares: image. The difference is the phase of the 11-year solar cycle. 2001 was a year of solar maximum, with lots of sunspots, solar flares and geomagnetic storms. 2008 is at the cycle's opposite extreme, solar minimum, a quiet time on the sun.

And it is a very quiet time. If solar activity continues as low as it has been, 2008 could rack up a whopping 290 spotless days by the end of December, making it a century-level year in terms of spotlessness.

Hathaway cautions that this development may sound more exciting than it actually is: "While the solar minimum of 2008 is shaping up to be the deepest of the Space Age, it is still unremarkable compared to the long and deep solar minima of the late 19th and early 20th centuries." Those earlier minima routinely racked up 200 to 300 spotless days per year. [More]

[via futurepundit]

Thursday, October 09, 2008

Remind me later to laugh...

Ba-dump-bump.

Try the veal.

``The commodity that may do the best is cotton,'' Smith says. ``Why? U.S. dollars are made of cotton, and Ben Bernanke has been printing dollars like crazy.'' [More]

Ba-dump-bump.

Try the veal.

It's real for Russian farmers...

Depending where funds are sourced, I have suspected ag lenders/banks will face the same situation as other financial firms (and even countries such as Iceland): lack of ability to lend due to eroded capital.

On the other side of the world, it's happening.

The idea any corner of finance anywhere will escape this black hole of illiquidity is questionable. Even if your bank is strong, there will be immense competition for loan funds. That means a higher interest spread will be possible for banks, even as the prime drops. And that's just the first complication I can think of.

Small wonder we will all soon be banking with Uncle Sam.

Depending where funds are sourced, I have suspected ag lenders/banks will face the same situation as other financial firms (and even countries such as Iceland): lack of ability to lend due to eroded capital.

On the other side of the world, it's happening.

The financial meltdown that started on Wall Street is now hurting farmers in Siberia, threatening a Russian agricultural revival that the United Nations says is needed to help avert a world food shortage.

Cash-strapped banks have cut funding to an industry already reeling from plummeting grain prices and soaring borrowing costs. The collapse of the stock market has closed off the other main money source for Russian agricultural companies, which produce nine percent of the world's wheat.

``Russian farmers may need to repay as much as $10 billion of loans by the end of the year,'' said Arkady Zlochevsky, president of the Russian Grain Union. ``Many farmers probably won't be able to borrow money for the spring sowing.''

Russian growers are putting on hold billions of dollars of expansion into vast swathes of Siberia, suggesting the harvest will weaken after this year, the best since the collapse of the Soviet Union. The UN Food and Agriculture Organization had estimated in March that Russia could double grain output by 2016.

Loan rates for farmers have jumped by half in some cases to more than 20 percent in the past few months, Zlochevsky said in an interview in Moscow. At least seven companies have abandoned planned share sales as the benchmark Micex Index in Moscow lost more than half its value since August. [More]

The idea any corner of finance anywhere will escape this black hole of illiquidity is questionable. Even if your bank is strong, there will be immense competition for loan funds. That means a higher interest spread will be possible for banks, even as the prime drops. And that's just the first complication I can think of.

Small wonder we will all soon be banking with Uncle Sam.

Wednesday, October 08, 2008

Another one bites the dust...

Well, not exactly, but I sure have been conditioned to think that way after hearing news like this:

This is how the credit crunch will affect us - by narrowing our choice of lenders.

Well, not exactly, but I sure have been conditioned to think that way after hearing news like this:

Insurance stocks plunged Wednesday after MetLife annouced it would be raising capital, cutting jobs and withdrew its 2008 earnings guidance due to the dramatic downturn in the world financial markets.Metlife had reportedly been in merger negotiations with The Hartford, without success. What I do know is my local Metlife ag loan rep has stopped taking loan applications.

In an effort to provide some semblance of certainty to nervous investors, MetLife (nyse: MET - news - people ) pre-annouced its third-quarter results, which it said will be hurt by a drop in investment income and fees due to the turmoil in the global financial markets. [More]

This is how the credit crunch will affect us - by narrowing our choice of lenders.

Help for the confused...

Perhaps you are wondering what the economic meltdown is all about. I hope this helps. [Adult language]

[via Mankiw]

Perhaps you are wondering what the economic meltdown is all about. I hope this helps. [Adult language]

[via Mankiw]

Tuesday, October 07, 2008

Some kind of "flation", anyway...

I have been leaning toward a scenario of increasing inflation, and as a result bear many scars and bruises from the current deflationary spiral. It would be human to stubbornly cling to me now-obvious mistake, but I still think we will experience a period of serious inflation. Here's why.

To downward plunge in housing prices must stop to permit any credit to flow and march to prosperity resume. To arrest that dive, world banks are creating and infusing money into all forms of financial institutions - and the biggest and boldest move of all may be about to happen.

Moreover, a little inflation could quietly devalue the monstrous debt we have added primarily by the bailout(s), but also with the war and fiscal foolishness. It is clear the Federal Reserve and other central banks has put inflation fears on the back burner - something to worry about after the economy is moving forward. I agree with this priority, but the overshoot in money supply will be significant, I believe.

For the meantime, the deflation hawks are in charge. And they make a powerful argument for why the dollar may not drop sharply - a principal feature of inflation.

Meanwhile, those few months will not be much fun for ag producers. If land values hold up, we'll be fine, and so far it seems to be a relatively immune asset.

If this seems a little Pollyannish, check out this graph of the loooong term outlook.

I have been leaning toward a scenario of increasing inflation, and as a result bear many scars and bruises from the current deflationary spiral. It would be human to stubbornly cling to me now-obvious mistake, but I still think we will experience a period of serious inflation. Here's why.

To downward plunge in housing prices must stop to permit any credit to flow and march to prosperity resume. To arrest that dive, world banks are creating and infusing money into all forms of financial institutions - and the biggest and boldest move of all may be about to happen.

The minute enough investors sense a bottom or even a slowing of deflating asset values, all those dollars will be chasing stuff to buy. That is classic inflation - too many dollars seeking too few goods and services.Published reports indicated that the government is planning a bold move to loosen credit markets. The Federal Reserve and Treasury Department are said to be considering buying commercial paper, short-term financing that companies use to fund day-to-day operations, from individual companies.

This would, in essence, put the Fed in a position of funding companies in order to keep the economy running. In the current credit crisis, companies are having a difficult time getting funds to operate. [More]

Moreover, a little inflation could quietly devalue the monstrous debt we have added primarily by the bailout(s), but also with the war and fiscal foolishness. It is clear the Federal Reserve and other central banks has put inflation fears on the back burner - something to worry about after the economy is moving forward. I agree with this priority, but the overshoot in money supply will be significant, I believe.

For the meantime, the deflation hawks are in charge. And they make a powerful argument for why the dollar may not drop sharply - a principal feature of inflation.

My inclination is to think the dollar will hold its value. I don't trust any of the macro models of currency values and we do know that purchasing power parity, while very approximate, and exerting its force only in the long run, does not imply a bearish stance toward the dollar.But if all currencies are inflating, this argument becomes less potent, and our currency can still devalue with inflation. This is what I expect in just a few months.

Here is a list of European banks with assets greater than the gdp of their respective home countries. And read this.

As for this country, the Chinese now regard us as "battle tested." We have been through some truly major bumps, yet no major U.S. politician has called for "not paying back the Chinese." We've even guaranteed the $350 billion in agency securities held by the Chinese central bank and without a stir. I think the Chinese are shocked by that and in many ways they now trust their investments more than before, not less.

The Chinese do not have comparable trust in "Europe." If something went wrong in the financial realm, who would they call up on the phone? Which country? What do they think is the power base of the head of the ECB? What political party does that person belong to? What favors can be traded and with whom? Whose answer would count as definitive? Keep in mind that for all of China's modernity, their leaders are still communist party functionaries.

The negative scenario for the dollar is where the Chinese economy collapses, not where the Chinese become too afraid to buy dollar-denominated assets.

Bush, Bernanke, Paulson -- we call them leaders. The Chinese think of them as the customer service department. I suspect the Chinese get straighter answers from them than we ever do. [More]